Evangelical billionaire Bill Hwang found guilty in multibillion-dollar stock fraud, racketeering trial

A billionaire who has claimed to be a devout Christian and was one of the Evangelical world's biggest benefactors was found guilty Wednesday in New York City of massive securities and market manipulation fraud that reportedly wiped $100 billion from the global market.

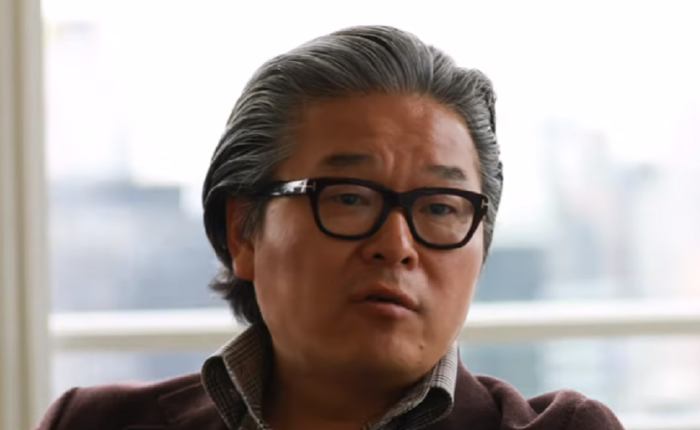

Bill Hwang, who founded the investment firm Archegos Capital Management in 2013, stared ahead and sipped water as the jury announced its verdict that he was guilty on 10 of 11 counts that included racketeering, securities fraud, market manipulation and wire fraud, according to The Associated Press.

Hwang was found not guilty on one charge of market manipulation that applied to one stock, but he could spend the rest of his life in federal prison. Patrick Halligan, who served as the former chief financial officer of Archegos, was also convicted of conspiracy, securities fraud and wire fraud.

Prosecutors with the U.S. Department of Justice alleged that Hwang and his co-conspirators illegally manipulated the prices of publicly traded securities and engaged in a scheme to defraud leading global investment banks and brokerages to grow their portfolio from $10 billion to $160 billion.

They alleged Hwang deceived banks regarding Archegos' substantial holdings in approximately 12 stocks, as The New York Times noted. According to prosecutors, they accomplished this using complex derivatives and loans.

While Hwang's lawyer maintained that his client was a high-risk and aggressive investor who invested in stocks he thought would do well, U.S. Attorney Damian Williams said at a news conference after Hwang's arrest in April 2022 that his actions "nearly jeopardized our financial system."

"But last year, the music stopped," Williams said. "The bubble burst. The prices dropped. And when they did, billions of dollars of capital evaporated nearly overnight."

When the firm collapsed in 2021, Hwang hemorrhaged $10 billion over 10 days, which also tanked the shares of the investment banks Nomura in Japan and Credit Suisse in Switzerland, according to The Wall Street Journal. UBS and Morgan Stanley also incurred losses.

The global market also saw about $100 billion wiped out.

Following the verdict this week, Williams claimed that both Hwang and Halligan "lied about Archegos's positions in these companies and just about every other materially important metric investment banks would use in determining the firm's creditworthiness."

Their lies allowed them to "fraudulently inflate a $1.5 billion portfolio into a $36 billion portfolio," he added.

Archegos was named for a Greek word meaning "chief prince" used in the New Testament to describe Jesus Christ.

Before his financial ruin, Hwang had helped to establish the Grace and Mercy Foundation, which reportedly had more than $500 million in assets at its peak, according to Reuters. He had also served as a trustee at Fuller Theological Seminary.

The foundation contributed to prominent Evangelical organizations such as Focus on the Family, the late Rev. Tim Keller's Redeemer Presbyterian Church in New York City, the Museum of the Bible, The King's College, Ravi Zacharias Ministries and others.

Jon Brown is a reporter for The Christian Post. Send news tips to [email protected]