Cheap grace socialism

Free College! Guaranteed Basic Income! Medicare for All! Cancel Student Debt!

These are the attention grabbers being used by various candidates for the Democratic nomination to run for the office of President of the United States. It is not easy to get noticed in a crowded field, so the temptation to offer free stuff is stronger than ever. But until there is a serious discussion about how to pay for these programs, they are nothing more than a politician’s empty promises.

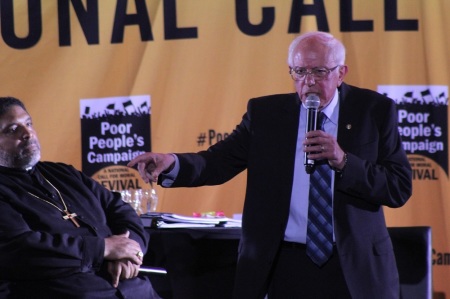

Senator Bernie Sanders, at least, is a true believer. He has consistently advocated for a greatly expanded welfare state during his entire, very long, political career. He has been in politics long enough to see the exhausted collapse of failed socialist economies in the Soviet Union and Eastern Europe. Bernie has seen the economic (and societal) rejuvenation of Britain, Brazil, Chile, China, India and Sweden when they changed from disastrous socialist policies and liberalized their economies with policies that encouraged economic freedom. More recently, Bernie has seen socialism rise to power in Venezuela and, once again, bring misery to the people.

Yet, despite a century of demonstrated failure, Bernie is still a believer in socialism. His vision is to remake America into a “democratic socialist” economy. Don’t compare his dream to Venezuela. He wants to make America into Sweden or Denmark, successful democratic countries with extensive social welfare programs. (Both countries have a high degree of economic freedom, which accounts for their success.) Bernie knows this requires very high taxes, but he is not ready to tell the people just how high the tax burden will be. But he is more honest than others, who seem to promise “no new taxes, except on the rich who need to pay their fair share”. Wealth taxes, death taxes, taxes on corporations, taxes on anything except the voter. It’s “cheap grace” socialism.

There are many reasons for the deadly failures of socialism, harming billions of people over the last century. But let’s focus on the tiny exceptions where welfare state policies, not socialism per se, have the support of millions of people and where the country has not been driven into ruin. Human nature will always “game” the system. It takes strong social cohesion for a welfare state to not disintegrate into ruin. The evidence of the last century shows that police power alone cannot prevent economic and social ruin of a country under a socialist system.

The strongest argument, in my opinion, for expanding the welfare state with a basic guaranteed income, or guaranteed government provided health insurance is that such welfare programs might help to unify society. The productivity of free people in a free economy could be shared with our less fortunate neighbors. But here’s the deal as I see it. It only has a chance to work if we share the burden equally. If we all sacrifice a truly fair share, that is, a mostly equal share, then perhaps such welfare programs might serve to strengthen the social ties that bind us together. On the other hand, if welfare programs are pitched to voters as “soak-the-rich”, to make the rich pay their “fair” share, then the welfare state will divide society into “makers” and “takers”. It will accelerate divisions already obvious in society today. Exorbitant tax rates will drive out the makers who have the chance to get out. The economy and society will go into long term decline.

We only need to look at the example of Sweden. From the 1950s to the 1970s, the Swedes expanded the welfare state and made egalitarianism into a virtue. They punished the rich with high income taxes, wealth taxes and exorbitant taxes on capital. High profile successful Swedes left the country to avoid the punitive taxes. From 1970 to 1990, their country got into a deeper financial mess, until Sweden experienced a financial crisis in 1992. Swedes generally wanted to keep the welfare state, but they realized that punishing the rich was not wise tax policy. The wealth tax was eliminated, among other reforms, and a new strict budget process was put in place. While the rest of the developed world, including the United States, has been running annual budget deficits and drowning in rising national debts, Sweden has been balancing its budget and reducing its national debt burden.

Sweden’s tax system is now broad-based and relatively flat. For starters, there is a 25% VAT tax (value-added tax, akin to a sales tax) on goods and 12% VAT on food. Everyone pays the tax. All workers pay a 7% tax on labor income to the Swedish version of Social Security up to a cap of about $3,250. Employers pay a whopping 31.42% of wages and salaries to Social Security. There is a flat income tax of 32% on all income above $2,000. There is an additional income tax of 20% on labor incomes above $52,000. There is yet another additional 25% income tax on labor incomes above $75,000. There is a flat 30% tax on income derived from capital (i.e., dividends and capital gains). Finally, there is a 22% tax on corporations (equal to the average tax on corporations in developed countries).

That is a lot of taxes. But the point that jumps out is that while it is a very high tax burden, it is shared more or less equally by everyone. Yes, there is a progressive income tax that hits the above average income worker, but it hits all above average income workers essentially the same. There is no “fair” share that the rich pay. The rich pay the same fair share as everyone else. There is an equality to the tax system that is congruent with the equality of the welfare programs themselves.

By the way, the story is similar in even more heavily taxed Denmark. The Danes have a 25% VAT, a maximum rate of 56% tax on labor income, 42% tax on capital income, and 22% tax on corporations. (They pay for their pension system by a 15.3% tax on the investment return on pension assets). As in Sweden, the high tax burden is borne more or less equally by all.

Candidates, ‘fess up. Free stuff is not free. How much do your programs cost? How do you propose we pay for it? Will we share the burden equally, or is your policy to punish the rich, tear apart American society, and start a slow march to financial disaster? The American voter will not ignore a century of failure, even if you continue to preach “cheap grace” socialism.