Ask Chuck: Preparing your estate plan

Dear Chuck,

We’re considering hiring a financial advisor to help us develop an estate plan. We want to protect and pass down our assets and possibly set up a giving fund that the children will jointly manage. Any suggestions on how to do this right?

Stewarding Our Estate

Dear Stewarding Our Estate,

It is encouraging to know that you are being faithful with the stewardship responsibilities of the resources God has entrusted to your care. The reality is that we all have an estate plan: either we are intentional about directing our resources to the stewards we desire to have the funds, or the government will decide for us. Far too many people overlook the careful transfer of their estate. The temporalness of our lives makes these decisions highly important.

How to choose the right advisor

Here is a very helpful article from Ron Blue Trust that is the beginning point: Five Questions to Ask When Receiving Financial Advice. Hopefully, you already have a will in place. Why? See here.

Choosing the who and what of your estate gifting

Speaking of wills, my good friend David Wills, president emeritus of NCF, the National Christian Foundation, says everyone needs a process to think through the details of an estate plan. He and his wife thought through their legacy using a framework of who, what, and when. David also says we should live in such a way that we pass down more than just money. There are three transferable capitals: spiritual, character, and financial.

- Spiritual: Do those to whom you plan to leave an inheritance know the Lord? Have you shared the hope you have in the Gospel?

- Character: What defines your family? David has emphasized the importance in his family of working diligently, living simply, and giving generously.

- Financial: This takes careful thought and planning. Find a like-minded financial advisor. Check with Kingdom Advisors and NCF’s library of information.

David stresses the importance of passing on wisdom before passing on wealth, based on King Solomon’s advice in Ecclesiastes 7:11–12:

“Wisdom is good with an inheritance, an advantage to those who see the sun. For the protection of wisdom is like the protection of money, and the advantage of knowledge is that wisdom preserves the life of him who has it” (ESV).

You can listen to an interview with him here.

This helpful verse may assist you in preparing your children to be wise stewards of the assets they may receive and place value in the sacred trust that is needed to make wise giving decisions jointly:

“If any of you lacks wisdom, let him ask God, who gives generously to all without reproach, and it will be given him” (James 1:5, ESV).

Ask in faith, receive His answer, then act in faith.

Ron Bare, another good friend and the founder of Bare Wealth Advisors, knows that money is an important part of everyone’s story. Capturing the story helps prepare the next generation for successful stewardship. It will also help the advisors you choose to understand you better. Ron gives the following advice in telling your story. I’ve pulled a few excerpts from the article here:

- Build a financial plan tailored to your story, values, purpose and goals. This will help you stay focused on what matters most in life. It’s like putting guardrails on the side of the road to protect you from going over the edge while you retain control of where you are heading financially.

- Write down your story and how it interacts with money. Think about questions such as: What was money like growing up? What was I taught about money and how to manage or care for it? What do I want to be remembered for? Answering these types of questions will help you clarify your values and what you want to communicate to the next generation.

- Define what is enough. Once you know this, you will unlock potential resources to pour into your purpose and the next generation. This could help you accomplish more than you imagined during your lifetime.

Preparing yourselves for that day

The great German reformer Martin Luther once said, “I have only two days on my calendar: today and that Day.” He was referring to the day that he would appear before the Lord Jesus Christ. None of us know when that Day will come, so it is good to live in the present fullness of today while being very intentional for the date the Lord calls us to our eternal home. Everything that we can claim as ours now will be left behind. Pour yourselves out by helping the next stewards of temporary money and possessions to live in a similar way.

Learn what the Bible says about money at Crown.org. We have online classes, budget coaches, a library of articles, tools, and more to assist you in stewarding money wisely.

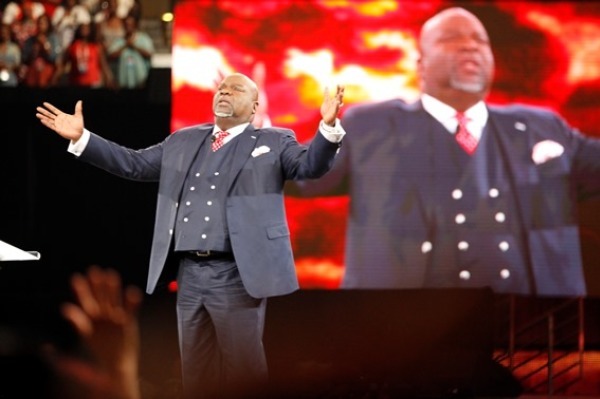

Chuck Bentley is CEO of Crown Financial Ministries, a global Christian ministry, founded by the late Larry Burkett. He is the host of a daily radio broadcast, My MoneyLife, featured on more than 1,000 Christian Music and Talk stations in the U.S., and author of his most recent book, Economic Evidence for God?. Be sure to follow Crown on Facebook.