Corning, the glass company, needs more transparency about religious freedom

As a member of a team which helps build and maintain investment funds (ETFs), and as an investor in them personally, I have been attending annual shareholders meetings of many of the U.S. companies in which I am invested. I have asked questions of the meeting organizers before, during, and after the meetings. My general focus has been on excess politicking, on issues that are not of core material operational importance, by publicly traded companies. The specific case in point is corporate endorsements of The Equality Act, as represented on the Human Rights Campaign's list of corporate partners in promoting the legislation.

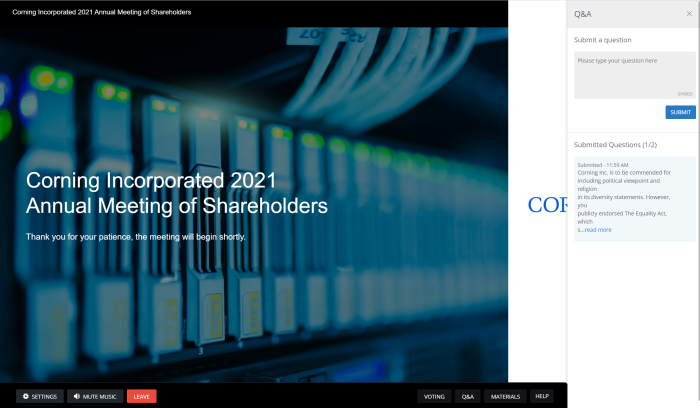

Corning is a good example. I clicked on the shareholder meeting link, filled out the requisite submission form, including the unique "Control Number" which is given to bona fide shareholders, and then I posted a question in the tab indicated for questions. Everything was in proper order.

During the Q&A portion of the meeting, we were told at the beginning that there were only two questions, then a question was taken, and then we were told that there was only one more question, and another question was taken, and then we were told, "That's it."

But that claim does not appear to be true. I had asked a question. It was a hard, but respectful, question. I asked it early and asked it via the proper channels. Suspecting that this question might be avoided, I took a screen shot to prove that the system registered it:

Corning does acknowledge, on-the-record, that the company did, in fact, receive the question.

Audio playback is available here: Events Platform (q4inc.com)

So, the question had been ignored at the annual meeting. Shareholders had been misled about whether the company had taken all questions, and both my follow-up email and phone call were also initially ignored.

So, I decided to write again and point out that, in addition to my role as part of an institutional shareholder, I am also a financial journalist, and that I plan to write about my concerns. Only after that did I receive a reply. That has generally been the pattern I have seen from companies which have ignored challenging questions such as this. When I ask as a shareholder… silence; when I ask as media… response. Does this mean companies are more concerned about their public image in the media than about small shareholder concerns? Perhaps. Giving the benefit of the doubt though, it may simply reflect the different levels of time-sensitivity for media (often on a deadline) and shareholders.

Corning’s answer is to remind me that it did promise, during the annual meeting, to respond later in writing. That is true, but does not address why the question was spiked during the annual meeting, and why it was implied that all questions had been taken. Answering later in writing is not nearly as risky to the CEO as answering during the live shareholder meeting. It's live and it corresponds with a news cycle--it's higher stakes. Answering a question days, or even weeks, later in writing in some corner of the company website (Microsoft Word - Q.docx (q4cdn.com)) is arguably lower stakes.

Then there's the issue of whether the "answer" really is genuinely an answer.

Here is the question I asked (with slight differences for the sake of brevity and privacy):

"Corning Inc. is to be commended for including political viewpoint and religion in its diversity statements. However, you publicly endorsed The Equality Act, which includes language which specifically precludes appeals based on the religious freedom and restoration act, demoting religious freedom. How do you square your statement protecting religious diversity with this support? Related: is it really necessary to entangle our company in such divisive political issues?"

I also sent the same question directly via email to the Investor Relations office of the company.

Here is the answer I eventually received:

"As one of the world’s leading innovators with 170 years of life-changing inventions, we know how important it is to foster an environment where every individual is treated with dignity and respect. Consistent with Corning’s Values, we believe in equal treatment for all employees regardless of sexual orientation and gender identity. LGBTQ people are our innovators, our friends, our family members, and our neighbors, and they deserve to be able to live their lives free from discrimination or harassment. Corning stands against all discrimination and has repeatedly supported legal protections for all lesbian, gay, bisexual, transgender, and queer people. In 2019, Corning joined more than 200 major corporations in signing an amicus brief filed with the U.S. Supreme Court related to its landmark ruling that discrimination in the workplace based on an employee's sexual orientation and gender identity is prohibited under Title VII of the Civil Rights Act of 1964. Corning also supports the Equality Act, which would provide consistent and explicit non-discrimination protections for LGBTQ people across key areas of life, including employment, housing, credit, education, public spaces and services, federally funded programs, and jury service."

Nothing about the religious liberty question. Nothing about the risks of embroiling the company in a divisive political issue.

Did Corning answer the question, as it promised to do? You be the judge.

So boycott the stock? No, I don't think that's the answer. I admire the company, which I think embodies the principles of human productivity as well as good leadership and governance. It's great at innovation, and its business policies tend to reflect an "owner-orientation." I think conservative and/or Christian sentiment is too often to simply dump companies, even well-managed ones, when they nod too easily to left-wing pressure. I think "come, let us reason together" is a better approach.

Speaking of which, I have been in off-the-record conversations with the company, and will be happy to update this story if and when it goes on-the-record about these matters.

Jerry Bowyer is financial economist, president of Bowyer Research, and author of “The Maker Versus the Takers: What Jesus Really Said About Social Justice and Economics.”