Should we blame Biden for the recession?

Many Americans believe the President controls the economy, which is why exit polls after a presidential election have shown, for decades, that the most important issue on the minds of voters in choosing a candidate is the economy. Economic indicators in the election year are the best predictor of the winner. If Gross Domestic Product (GDP) is growing at or above average, the incumbent party usually wins. If not, the challenger wins. President Trump lost his bid for a second term in office largely because of the recession caused by COVID.

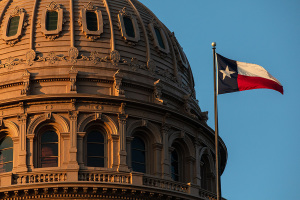

U.S. real GDP fell last quarter by 0.9% from the first quarter, which had also declined by 1.6%, causing many pundits in the news business to declare that we are in a recession. Republicans have tagged it the Biden recession, while the President has tried to redefine the term to not take the blame. Both parties see the state of the economy as a factor in determining the outcomes of the congressional elections this November.

The National Bureau of Economic Research (NBER) is responsible for declaring a recession, but it may not consider the recent decline in GDP to qualify as one because it doesn’t follow the media definition. “The NBER's traditional definition of a recession is that it is a significant decline in economic activity that is spread across the economy and that lasts more than a few months.” With unemployment at records lows and millions of job openings, this doesn’t feel like a recession. So the NBER may come to Biden’s rescue by not calling the recent decline a recession.

If it does declare that the two quarters of declining GDP are a recession, what responsibility does the President shoulder for it? That depends on what you think causes recessions. Most voters know little about economics and think an inept President causes them. There is some truth to that. Presidents can cause what the great economic historian Robert Higgs called “regime uncertainty” to describe how President Roosevelt extended the Great Depression. FDR devoted hours to attacking and threatening businessmen with higher taxes, more regulation, and confiscation, which caused greater uncertainty about the future. As a result, they quit investing in new business ventures that create jobs.

Recall how the economy soared after President Trump was elected, but before he took office? Higgs’ “regime uncertainty” partly explains it. President Obama had attacked businesses throughout his two terms. Remember his famous line from the 2012 campaign, “If you’ve got a business, you didn’t build that. Somebody else made that happen.” President Trump relieved Obama’s regime uncertainty before he took office so businessmen felt comfortable in investing for the next four years. Biden and his administration have created uncertainty among businessmen similar to that of FDR and Obama, so naturally a recession is likely.

Mainstream economists roll their eyes at the regime uncertainty explanation. Their favorite answer is “stuff happens!” They use more technical jargon. And they throw the consumer under the bus for not spending enough. But ask why consumers stop spending and they will say, “Stuff happens!”

Other than Higgs’ regime uncertainty, and recessions caused by wars or pandemics like COVID, the best theory of recessions is the Austrian Business-Cycle Theory (ABCT). Originally distilled by Ludwig von Mises and further refined by F. A. Hayek, the ABCT shows that modern recessions begin with an unsustainable expansion of the economy through the Federal Reserve’s policies of responding to a recession by reducing interest rates below the market rate, also called money printing. Fed policy causes businessmen to launch many risky ventures that can’t succeed without those lower interest rates. Eventually, falling profits or inflation persuade banks or the Fed to rein in credit expansion, a recession occurs, and the cycle starts again.

God’s plan for the economy calls for private property and free markets. In money, that means a gold standard. Governments hated the gold standard because it restrained how much they could spend without increasing taxes. Politicians know that voters couldn’t care less how much the government borrows and spends, but they will revolt against higher taxes. To borrow all they want, governments must control the money supply, the private property of its citizens. Then the government robs the lenders by printing more money (through credit expansion) and creating inflation. Since its creation in 1913, the Federal Reserve has stolen 96% of the value of the U.S. dollar.

Recessions in the 19th century, under the gold standard, were shorter, shallower, and were mostly caused by wars and government manipulations of banks to escape the restrictions of the gold standard. The U.S. saw its greatest leap in standard of living (reduction in poverty) under the gold standard.

Socialists have maintained for over a century that recessions happen because capitalism is inherently unstable. In one sense they are right: tribal people living in the Amazon rain forest don’t experience recessions or expansions. However, regime uncertainty and the ABCT point to one culprit: the government.

The Bible says, “Do not put your trust in princes, in human beings, who cannot save. When their spirit departs, they return to the ground; on that very day their plans come to nothing. Blessed are those whose help is the God of Jacob, whose hope is in the Lord their God.” (Psalm 146:3-7)

Americans don’t want to hear that. They want to keep alive the fiction that their government is all-wise, all-knowing and all-compassionate. Christians know it is not.

Roger McKinney is the author of Financial Bull Riding and God is a Capitalist: Markets from Moses to Marx.